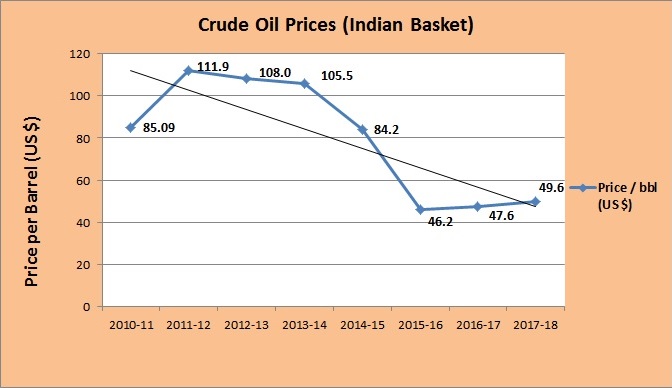

Soaring fuel prices have been in the headlines over the past few weeks as the Narendra Modi led BJP government came under fire on social media for failing to rein in prices . In 2012, when crude oil prices were at $111.9 per barrel, petrol prices were at Rs 70 per litre. Today with crude oil prices having fallen more than 50%, retail selling prices of petrol and diesel remains the same or even higher.

In this fact file, we answer some of the commonly asked questions about fuel prices and why they continue to remain high despite fall in international crude oil prices.

1) How has oil prices changed with crude oil prices?

In the seven year period between 2010 to 2017, average crude oil prices was the highest in 2011-12 and since then has gone down. It has decreased by 56% from $111.9/ bbl in FY 12 to $49.6 / bbl in FY 18. In other words, today crude oil prices are less than half of prices in 2012.

Source: Petroleum Planning and Analysis Cell

Note : Data for 2017-18 is till August 2017. Price refers to the average prices of the months in a Financial Year.

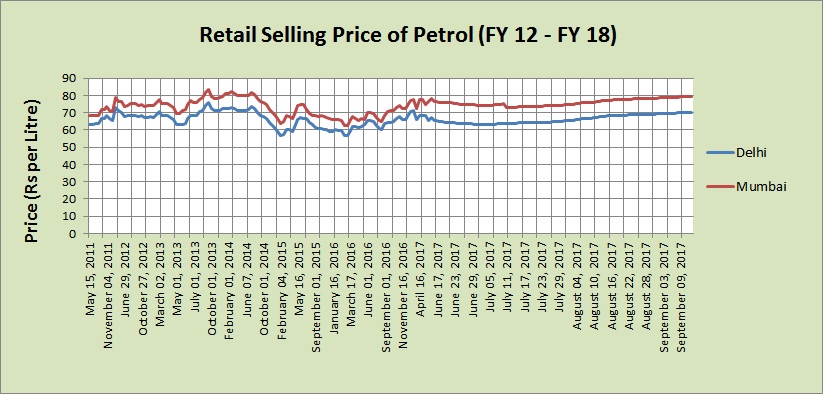

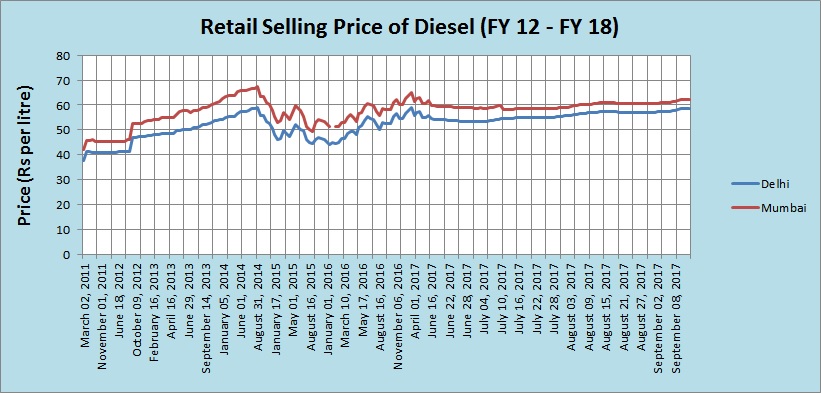

Now, let us look at Retail Selling Prices (RSP) of petrol and diesel since 2012.

Source: Petroleum Planning and Analysis Cell

Source: Petroleum Planning and Analysis Cell

The drop in crude oil prices by half is not reflected in retail selling prices (RSP) of petrol and diesel. RSP of petrol has crossed Rs 70/ L and RSP of diesel is around Rs 60 / L in Delhi and Mumbai.

And more so, after the implementation of dynamic fuel pricing since June 2017, we see a steady increase in retail selling prices of petrol and diesel. Dynamic pricing refers to revision of fuel prices based on international prices on a daily basis.

2) Why are we still paying more for petrol if crude oil prices have gone down?

The answer lies in the components of the petrol prices we pay. Here, we look at the build-up of petrol prices in India.

RSP of Petrol / Diesel = Price charged to dealers + Central excise duty + State VAT + Dealers commission

Price charged to dealers includes crude oil prices and international freight charge based on exchange rate and internal freight charges.

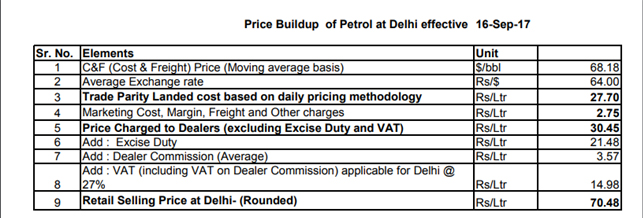

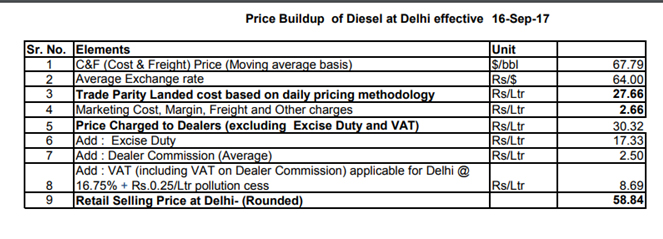

Given below is the price build-up of petrol and Diesel at Delhi on September 16 –

Source : IOCL

A consumer paid Rs 70.48 per litre of petrol. When petrol reaches the pump, the dealer is charged Rs 30.45 per litre. From here on, you pay 5% for dealer commission and 52% for taxes to governments. Out of the Rs 36.5 that went as tax to the government – 30.5% went to the centre and 21.3% to the state.

Similarly in the case of diesel, out of the Rs 58.84 paid per litre of diesel, 44% (Rs 26.02) went as tax to the government – 29.5% to the centre and 14.8% to the state.

Source : IOCL

We see that taxes form a major part of retail selling prices. Therefore, the reason for high oil prices is the high taxes levied on petrol / diesel.

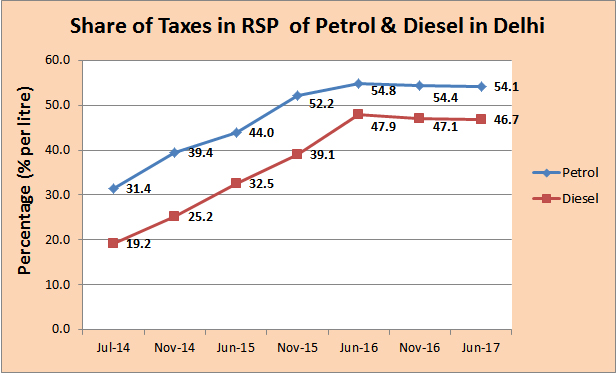

3) How has tax share in oil prices changed over time?

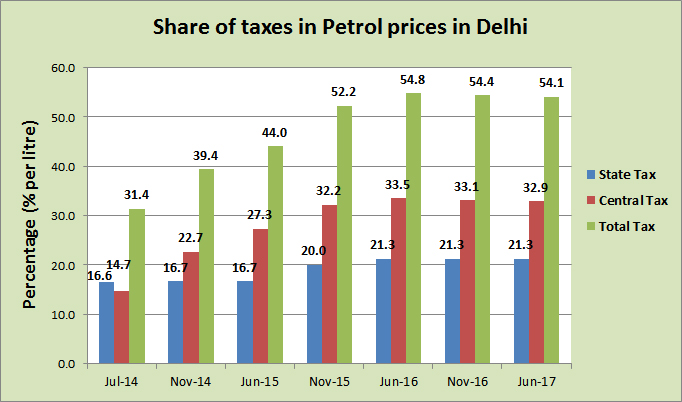

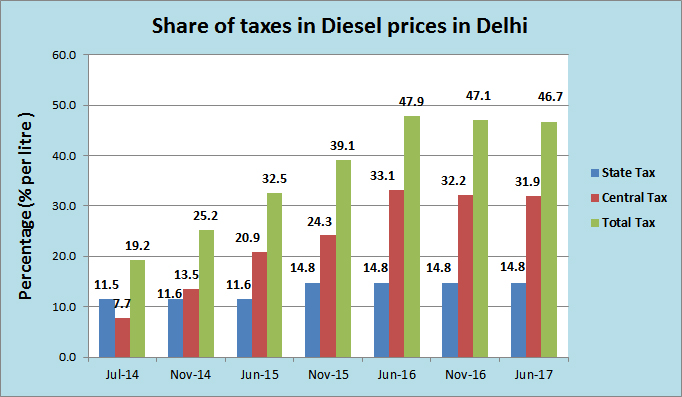

It is a fact that both central and state taxes have increased over time. And, the increase in the rate of taxes has clearly increased the share of taxes in the prices we pay for petrol and diesel at the pump.

As shown in the graph below, the tax component (both central and state taxes) in the RSP has risen from 31.4% in July 2014 to 54.1% in June 2017 in the case of petrol. The corresponding increase for diesel was 2.5 times from 19.2% to 46.7%.

Source: PPAC Ready Reckoners (Click here - 1, 2, 3, 4, 5, 6, 7), Ministry of Petroleum and Natural Gas

4) Of the tax we pay, what goes to the centre and to the state?

In the recent times central taxes have increased steeply owing to a large share in oil retail selling prices. And, if we are to compare the increase in tax rates, the centre gets more than the states.

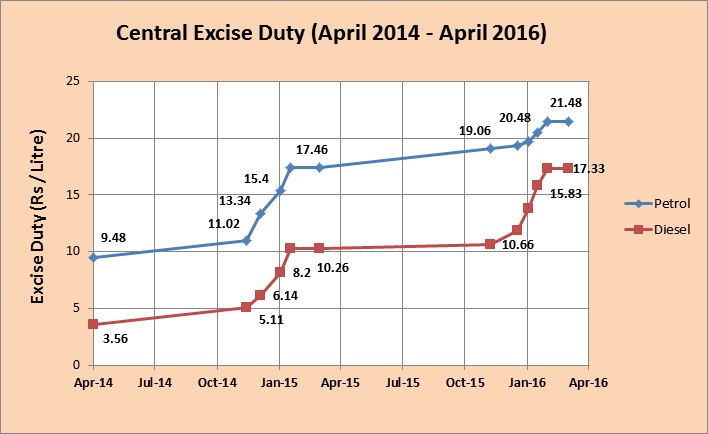

Central excise duty has increased by 126% for petrol from Rs 9.48 / L in April 2014 to Rs 21.48 / L in April 2016. Central excise on diesel has increased by 386% from Rs 3.56 / L in April 2014 to Rs 17.33 / L in April 2016.

Source: Lok Sabha Question dated March 2017

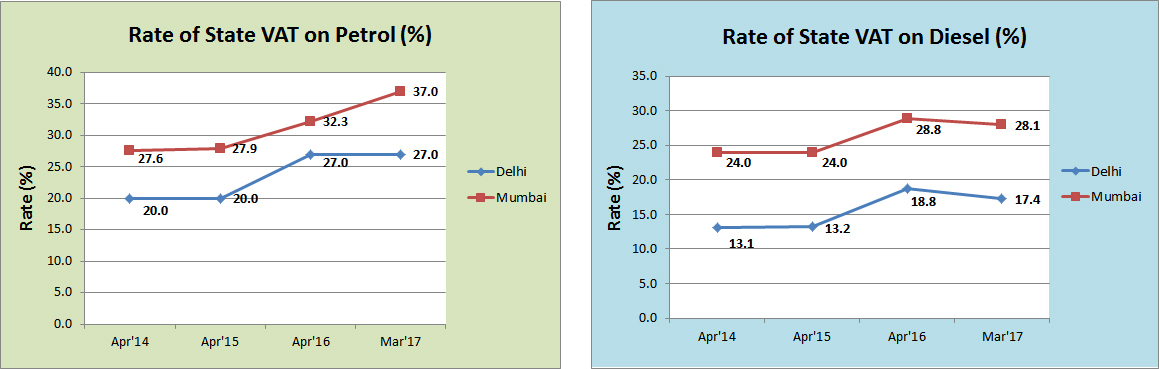

On the other hand, state taxes in the form of sales tax / VAT have increased, but in lower proportion. State taxes on petrol in Delhi increased by 35% and diesel by 32% between April 2014 and March 2017. The corresponding increases in Mumbai are by 35% and 17%. Rate of state taxes in the form of VAT / Sales tax vary for different states.

Source: Lok Sabha Question dated March 2017

The graphs below segregates central and state tax share in the total tax share in RSP of petrol / diesel. As seen, the increase in tax component in oil prices has been mainly driven by the increase in central taxes.

Source: PPAC Ready Reckoners (Click here - 1, 2, 3, 4, 5, 6, 7), Ministry of Petroleum and Natural Gas

Share of central taxes in total taxes increased by 18.2 percentage points between July 2014 and June 2017 while that of state tax increased moderately by 4.7 percentage points.

Source: PPAC Ready Reckoners (Click here - 1, 2, 3, 4, 5, 6, 7), Ministry of Petroleum and Natural Gas

Share of central taxes in total taxes of central taxes increased by 24.2 percentage points between July 2014 and June 2017 while that of state tax moderately increased by 3.3 percentage points.

5) What about VAT rates in other states?

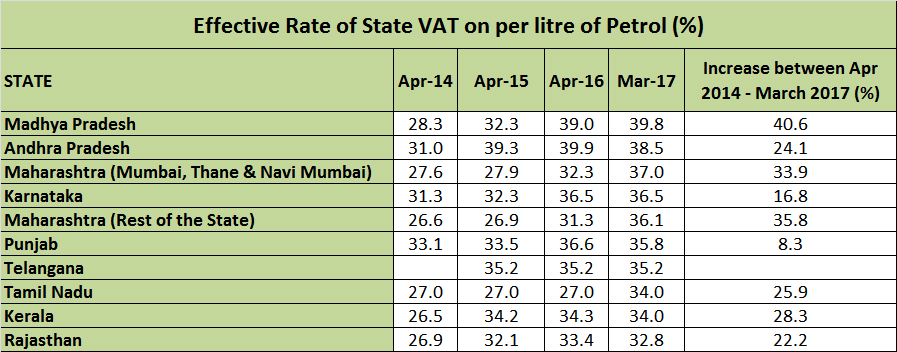

Like Delhi, other states have also increased rates of state VAT. Effective state VAT on petrol and diesel in top 10 states (as of March 2017) are as below:

Source: Lok Sabha Question dated March 2017.

As of March 2017, 74% of States / Union territories (25 / 34) charges sales tax above 25% for 1 Litre of Petrol while it was 50% in April 2014.

Source: Lok Sabha Question dated March 2017

The states in their bid to increase revenue have indeed increased the effective VAT rates. However, it has not been as steep as the increase in central taxes.

6) Increase in state VAT rates has not led to proportional growth in state tax revenue

Despite increase in rates, the tax revenue has not seen a major rise, which can be demonstrated by comparing the increase in central and state tax revenues.

Though data on exact tax revenue from the sale of petrol and diesel are not available, data on total tax revenue on Petroleum products (POL products) are available. It includes revenue collected from the sale of petrol, diesel, PDS kerosene and LPG. While state VAT rates on petrol and diesel are mostly above 20%, VAT rates on PDS kerosene and LPG have not crossed 8% in any of the states / UTs.

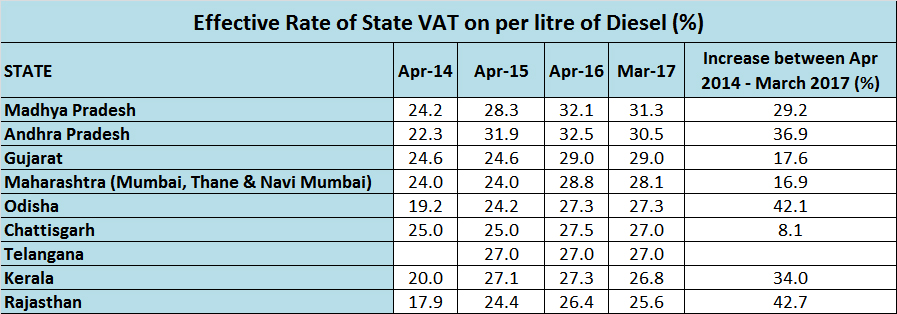

The graph below places central and state tax revenues side by side.

Source: PPAC Ready Reckoner June 2017

What we see in the graph is a stark difference in the increase in sales tax revenue and central tax revenue.

Compared to a 21% increase in state tax revenue between 2014-15 and 2016-17, central tax revenues increased by 144%.

But what could explain the increase in central tax rates which has led to exorbitant petrol prices?

7) Higher tax revenue will drive infrastructure development, says the government

While higher taxes may not mean good news for the consumer, it has meant a windfall for the government. Excise duty revenue from the petroleum sector rose from Rs 77,982 crore in 2013-14 to a whopping Rs 2,42,691 crore in 2016-17.

“One part of the fall in oil prices as a part of proper economic and fiscal planning goes to the consumer; the second part is going to developmental activities, particularly national highways and rural roads, because those who consume petrol and diesel drive vehicles on these roads, and they must pay for it. The third part is being consumed by the states by way of VAT. Of what the central government gets, 42% is being passed on to the states. And the fourth part, let me tell you, goes to the oil companies for the reason that when oil companies make international purchases against future purchases, they suffer a huge loss. They buy at 80 dollars; by the time they sell, the price has become 60 dollars. At one stage, the loss of the oil companies was as high as Rs 40,000 crore.” - said Finance Minister Arun Jaitley, in Rajya Sabha on December 16, 2015.

‘The government cannot change fuel pricing on a knee-jerk basis’, said Dharmendra Pradhan, the Petroleum Minister. “The government will not interfere in the day-to-day functioning of the OMCs… for the last three years, the pricing mechanism has been linked to the market,” he said.

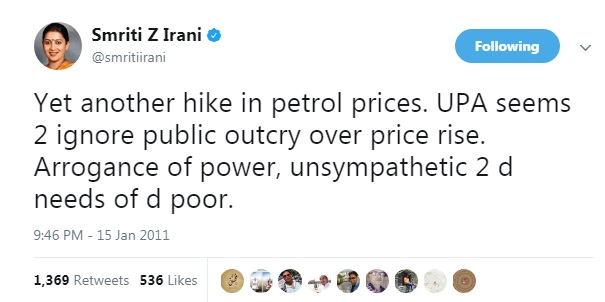

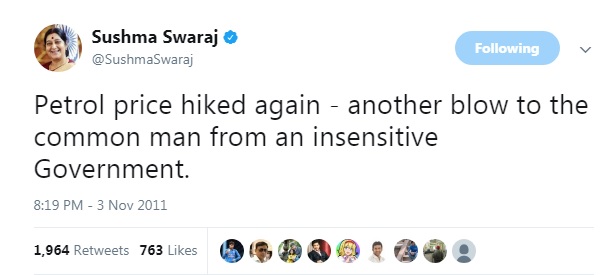

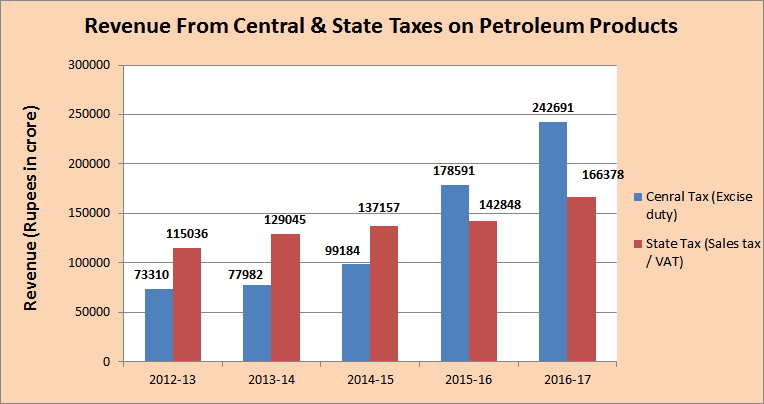

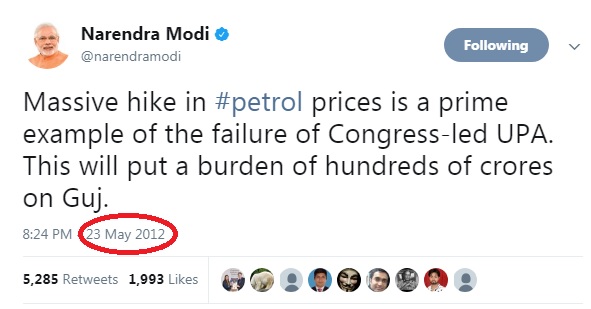

While the BJP took a strong economic position as they defended the prices, people have pointed out that it is doublespeak on their part.

8) How did the BJP’s stance differ on the issue of high petrol prices before coming to power?

An old tweet and video by Narendra Modi during his term as Gujarat chief minister were revived on social media to remind him of his pre-election promise to reduce the burden on the aam aadmi.

Not only Narendra Modi, several BJP leaders including current I&B minister – Smriti Irani and External Affairs Minister - Sushwa Swaraj were in the forefront to protest high petrol prices.