People queue outside a bank to withdraw cash and deposit their old high denomination banknotes in Mumbai

People queue outside a bank to withdraw cash and deposit their old high denomination banknotes in Mumbai

High denomination notes of ₹500 & ₹1000, 86.4% of the total currency in circulation ceased to be legal tender due to demonetisation. RBI denotes these demonetised notes as “Specified Bank Notes” (SBN). As per RBI Annual Report 2015-2016, as of March 31, 2016, the value of the total SBN is ₹14.18 lakh crores. Volume wise, it consists of 15707 million ₹500 notes and 6326 million ₹1000 notes - a total of 22033 million notes. Meanwhile, the total currency in circulation, value wise increased to ₹17.975 lakh crores (4/11/2016) from ₹16.415 lakh crores (31/03/2016)

Exact information of the amount of SBN as on November 8 is now in public domain, thanks to a question-answer in the Rajya Sabha, which shows 17165 million pieces of ₹500 (₹8.582 lakh crores)and 6858 million pieces of ₹1000 (₹6.858 lakh crores) in circulation (Total Value: ₹15.44 lakh crores, Total Volume:24023 million pieces).To print and replace 24023 billion notes is an enormous challenge considering this sheer volume of notes to be printed and capacity of our printing presses.

Capacity of Printing Presses

How can RBI achieve this target with resources at their disposal?

How much time RBI will take to print and replace SBN with new notes?

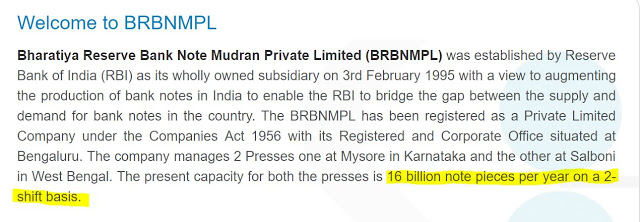

To understand this, in a pure resources management perspective, we have to examine the output capacity of our currency note printing presses. We have two currency printing presses under Security Printing and Minting Corporation of India Limited (SPMCIL), one at Nashik in Maharastra and the other one in Dewas in Madhya Pradesh. Nashik Press was established in 1928 and Dewas was in 1974. Also two more modern currency printing press were added later to augment the printing capacity, one in Mysore in Karnataka and the other at Salboni in West Bengal under the Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL), which were established by Reserve Bank of India (RBI) in 1996.

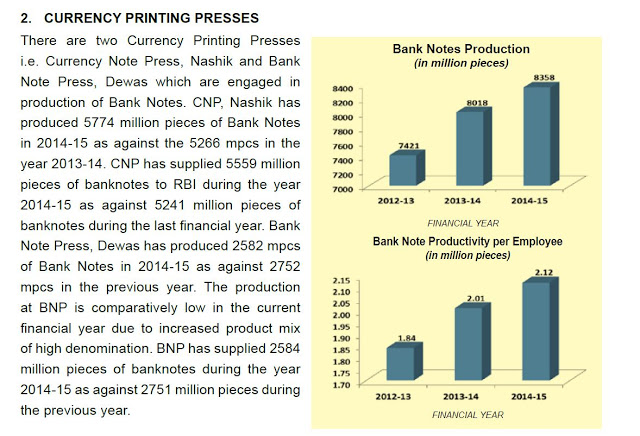

First look at the capacities of Nashik & Dewas presses under SPMCIL. I have relied on the Annual Report of the SPMCIL as well as a presentation available on the internet by the Currency Management Wing of the RBI. From the above records, it is inferred that Nashik Press capacity is 5800 million notes per year and Dewas capacity is 2620 million pieces.

Meanwhile, BRBNMPL's Mysore & Salboni together can print 16000 million notes in 2 shifts in a year. See the screenshot of BRBNMPL website. So all these four presses can together print 24420 million currency notes in a year and this is closer to the supply RBI getting for last 3 years too.

So all four presses together having a printing capacity of 66.90 million/day. If we take Mysuru and Salboni alone, this will be 43.84 million/day.

Printing abroad is out of question

My next exercise was to understand whether we can outsource this currency printing to any high quality security presses abroad. That research lead me to the Report of Committee on Public Undertakings (2012-13) which deliberates “outsourcing of printing of currency notes” as recommendation serial no.14. Selected extract from the above report is reproduced here:

“The Committee also find it pertinent to point out that during printing of currency notes worth 1 lakh crores in three different countries, there was always a grave risk of unauthorized printing of excess

currency notes, which would have been unaccounted money. The Committee simply wonder how come a decision was taken to have the currency notes printed by above mentioned companies in three different countries.Logically speaking since all the said three countries are well developed, each country certainly had the capability of undertaking the entire printing assignment. In any case the very thought of India’s currency being printed in three different countries is alarming to say the least. During that particular fateful period our entire economic sovereignty was at stake.

The Committee is concerned of the grave implications of such a move as it has wider ramifications in a multi faceted angle. The danger of destabilizing the economy by the agencies of authorities who could

have misused our security parameters vis-à-vis printing of currency notes, the use of such notes which could have been printed in excess could easily have fallen in the hands of unscrupulous elements such as terrorists, extremists and other economic offenders, looms large in our minds. The Committee expresses its strong resentment over such an unprecedented, unconventional and uncalled for measure. The Committee while recommending that SPMCIL be strengthened to undertake the printing and minting of the required currency notes/coins fervently emphasise that outsourcing of printing of currency notes/minting coins should never be resorted to in the future.”

Reply of the Government

Since corporatisation, SPMCIL and BRBNMPL have been

meeting the requirement of coins and currency and no import has been resorted to. The concerns and recommendations of the Committee have been carefully noted for future guidance.

[Ministry of Finance, Department of Economic Affairs]

( O.M. No.3/8/09-SPMC dated 3rd January, 2013 )”

So this assurance rules out the very question of outsourcing of the currency printing abroad. I don’t think RBI will violate an assurance given to the Committee of Public Undertakings of the Parliament. Hence RBI has to depend on the four presses in our country to meet this enormous demand.

Comparison with demonetisation done in 1977-78

In this context, we have to note that during the demonetisation exercise in 1977-78 only less than 5% of the high value notes were demonetised. It is also important to note that ₹100 note, which was 50.1% of the total currency in circulation was not demonetised during 1977-78. Contrary to the above, this time RBI and Government decided to demonetise ₹500 note, which consists of 47.8% of the value of the total currency in circulation. They also demonetised ₹1000 notes in circulation, thus made 86.4% of value of total currency in circulation redundant, which choked and paralysed the entire cash based economy with a whimsical direction overnight!

₹2000 note - a short shrift solution

Now look at the ₹1000 notes, volume wise its quantity is 6858 million notes. If you convert the entire ₹1000 notes to

₹2000 notes, keeping the same value, then the volume will be halved to 3429 million notes to facilitate quick printing and disposal. But there is a catch, RBI has to tweak the ratio between ₹500 and ₹2000 to provide easy change and mobility between these two notes. So obviously, there should be less volume of ₹2000 notes and more volume of ₹500 notes is mandated to keep the equilibrium of the system.

For the time being, let us assume that RBI has gone with a complete swap of ₹1000 with ₹2000 notes totally discarding the mobility in the system . Definitely this is a short shrift exercise without considering the much needed mobility and velocity of the demand of thes various denominations of the currency notes in circulation. In that scenario too, RBI has to print at least 20594 million notes (17615 million ₹500 &+ 3429 million ₹2000) in a short span of time.

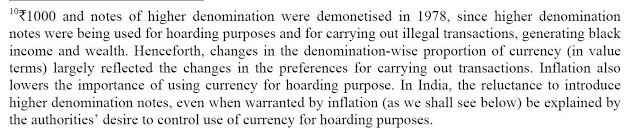

Higher denominations will aid hoarding - RBI Study

The elimination of ₹1000 note and introduction of ₹2000 note is really perplexing and the RBI's explanation made themselves a joke. In this context, invite your attention to RBI Study No. 39 “ Modelling Currency Demand in India: An Empirical Study” to see how RBI and Government of India all along resisted to issue high denomination notes even when warranted in a short time to control inflation, considering the chances of this high denomination currency will be used for hoarding purpose by the black money holders.

The irony is now a high value currency note of ₹2000 is introduced in the guise of controlling black money, but at the end of the day help the hoarders in transporting and hoarding unaccounted cash. This haste and irrational decision was taken without considering the statistical principles of distribution of various denominations in the currency in circulation and also fully sidelining the prudent decision to eliminate the chances of hoarding. This short shrift route of going for ₹2000 by RBI without considering any of the above consequences into account and only taking the ease of printing, is a telling reflection of how an institution like RBI let itself to erode its independent stature to please the political masters.

Printing target - An estimation

I discarded here the essential tweak required for maintain the equilibrium between ₹500 and ₹2000 notes and also the increase of currency required to meet the demand of cash in the economy in the coming months till this disaster is mitigated. Many of the government sympathisers may definitely point that the entire ₹15.44 lakh crores of SBN will not return into the system and there is no need to replace the entire currency. My opinion is that these two factors balance and neutralise each other. Hence for the time being, I decide to go ahead with the figure of 20594 million new notes as our target for printing.

In the initial days, the WhatsApp army were busy in forwarding daring claims that only 50% of the SBN will return into the system. Even our Attorney General told the Supreme Court that RBI & Government expects only a maximum of ₹12 lakh crores of SBN to return to the system. Today we are hearing from the media quoting Ministry of Finance sources that around ₹14 lakh crores worth SBN is already returned to the system.

Remember that we are still 13 more days away from the date set by Government to deposit the SBN at banks. So its time for RBI & Government to eat the humble pie. It is important to understand that the above cut-off date will not set free RBI’s responsibility to exchange the rest of the currency in circulation at their counters, it only limits the option of depositing/exchanging at banks. That is a detailed matter as it entangled in legal provisions and other issues and hence will be discussed in a future post.

Demonetisation Planning - Rajan or Patel?

To understand the currency printing schedule, first see the letter of transmittal dated 29th August 2016 of the RBI

Annual Report 2015-16 signed by former Governor Raghuram Rajan. Kindly note the above date, it is very important. We know that the present Governor Urjit R. Patel assumed office on 4th September 2016.

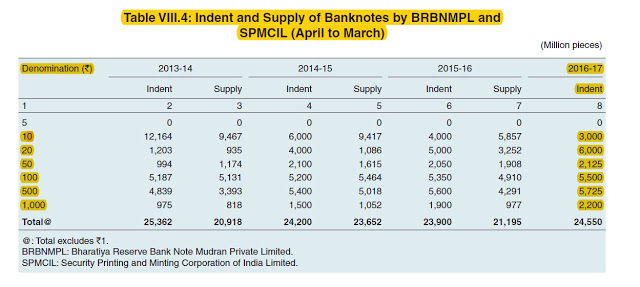

Now look at the same Annual Report again. Look at Table VIII.4, "Indent and Supply of Bank Notes by BRBNMPL & SPMCIL". Look at the indent for the year 2016-17, RBI has given an indent for 5725 million ₹500 notes & 2200 million ₹1000 notes along with other lower denomination currency notes. If there was a plan in advance to demonetise these denominations, then why did the RBI print and disburse such large quantities of SBN in to circulation? This is nothing but sheer wastage of exchequer’s money.

Moreover, if RBI had such an advance plan to replace the above SBN, they should have devoted their time and energy to print lower denominations notes instead of SBN. Hence it is beyond doubt that the entire demonetisation plan came into picture after Urjit Patel had taken charge. The new denomination note of ₹2000 bear the signature of the new Governor Patel, not of Governor Rajan, which is also another explicit evidence to prove that these notes were introduced after Governor Rajan left RBI.

When new currency printing started?

So what is the possible date of starting the new currency printing, yes, after this so called meticulous planning, selling an amazing idea and getting a nod from high echelons to go ahead with the ‘surgical strike’? Many theories are floating in the air about this meticulous planning in the initial days by a certain section of cheerleader media and court jester journalists. I am not ready to buy any of those theories. We learnt from media reports that the printing of the new notes were confined to RBI’s BRBNMPL presses at Mysuru & Salboni.

Neither Nashik nor Dewas of SPMCIL were on the loop, may be due to the secrecy of the mission involved. Another reason may be both these presses were already assigned with printing of the lower denomination notes (from ₹100 downward), which is already intended in huge quantities by the annual indent of RBI for FY 2016-17.

Considering all these constraints, let me put a rational date before you considering the resources planning angle. RBI disclosed that they have 2473.2 million ₹2000 in stock for disposal as of 8/11/2016 in response to a RTI query. With the printing capacity of 43.84 million/month of Mysore & Salboni together in 2 shifts, it will take 57 days to print the 2473.2 million notes, that means it started on 12th September 2016. Take another possibility, that RBI took an effort to enhance printing to 3 shifts from 2 shifts, then they can print 65.76 million/month, i.e, means it will take 38 days, that means printing started on 1st October 2016 only.

I was really shocked to find that there was not a single ₹500 note with RBI when they unleashed this demon over the nation! That means RBI unleashed demonetisation with just 32% of the total SBN in circulation, that too a less mobile ₹2000 note stock. They were also aware that within the 50 days window period, they can't print the rest of the SBN too!

Disbursal of Currency

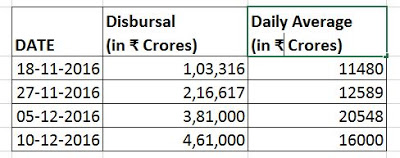

Then, I look for patterns of disbursal of currency at various dates, which was inferred from the data provided through the press releases by RBI. Look at the table below:

We can see that there was a substantial increase of disbursal of currency between 27/11/06 and 05/12/16 from ₹12589 crores/day to ₹20548 crores/day, this is definitely due to the disbursement of salaries on the first of December. Thereafter, the disbursal drying up substantially in the succeeding period to ₹16000 crores/day.

If we take the entire 31 days of demonetisation, the average daily release from 10/11/2016 to 10/12/2016 is ₹14871 crores/day.

If the money is disbursed in the above daily average rate, between next 20 days, a further ₹2,97,420 crores can be disbursed. Hence Government may be able to disburse a total of ₹7,58,420 crores or a maximum of ₹8,00,000 crores by 30/12/2016. That means just 52% of the total SBN going to be disbursed to us. But even this quantity is doubtful with the present printing woes, which is going to be examined in the subsequent paragraphs.

There is some serious cash delivery issue in the system due to inferior planning and poor judgement from the part of RBI as well as Finance Ministry. Otherwise what is the justification of various new restrictions unleashed day to day basis by RBI without respecting the notification dated 8/11/2016? It is quite depressing to see that even the address to the nation by the Prime Minister is not honored.

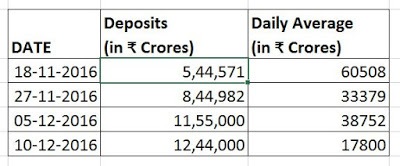

Estimation of possible return of SBN

Now look at the way SBN is coming back to the banks. This table extracts information from various press conferences.

This table will explain to you why the Government & RBI are in panic and imposing new restrictions like deposits up to ₹5000 to non-KYC accounts and questioning people depositing more than ₹5000 into their KYC accounts. Why we are treated like criminals? Under which legal or constitutional provision Government and RBI arbitrarily gives this police power to the bank authorities to abuse us?

This is becoming a theatre of absurd when the very Government, who is reluctant to reveal to public the names of celebrities and big shots who keep thousands of crores of black money abroad arm twisting the common man and honest tax payers!. Tell us what is the crime committed by us? Are you intimidating and insulting us for believing the Prime Ministers address to the nation on 8/11/2016??

Look at various possibilities on 30/12/2016 (20 days from 10/12/2016)

- With an average daily inflow of ₹15000 crores, entire SBN valued ₹15.44 lakh crores will return to banks

- With an average daily inflow of ₹12800 crores, total SBN valued ₹15 lakh crores will return to banks

- With an average daily inflow of ₹10300 crores, total SBN valued ₹14.5 lakh crores will return to banks

My strong belief is that SBN valued around ₹15 lakh crores will most probably return to the system, rest of the SBN will be trapped in Nepal & Bhutan and other countries for the time being. If ₹15 lakh crores of SBN return, then it will totally shatter and tear away all mighty claims by the Government and RBI that a maximum of ₹11 lakh crores to ₹12 lakh crores of SBN will only return to banks.

This story first appeared here on December 20. This is a shorter, edited version. Pls refer to the original post for the full version of the article.