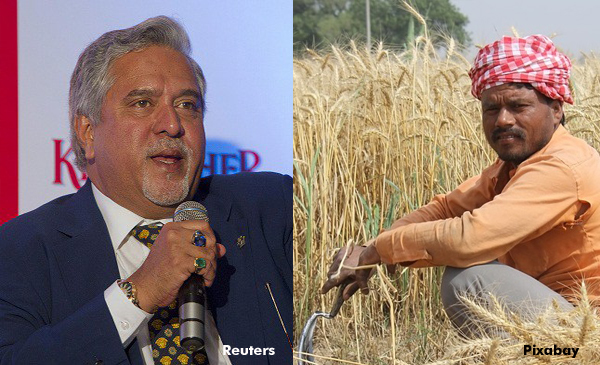

Even as fresh controversies erupt over rising NPAs in the corporate sector and farmers demanding their debts be eased, ‘write-off’ and ‘waiver’ are two words that have become synonymous, creating quite a political stir in the country.

‘Write-off does not mean that the loan ceases to be a loan. We will still chase the loan. The entry in the book changes that is from being performing assets, it become a non-performing (asset)’, clarified Finance Minister Arun Jaitley in the Parliament in 2016 even as opposition criticized the government for making people stand in queues after demonetisation while loans of wilful defaulters were written off, including that of business tycoon Vijay Mallya.

Recently, the Twitter handle of BJP Karnataka slammed Congress President Rahul Gandhi for using these words interchangeably to score a point against the party. In his campaign speech in Karnataka, Gandhi accused the BJP government for treating the rich and poor differently. He said in Hindi, 'Hindustan ke sabse ameer 10-15 logon ne Rs 8 lakh crore aapka le liya. Pichale saalon mein BJP ne Rs 2.5 lakh crore 15 sabse ameer logo ka karja maaf kiya hain. Magar jab kisaan karja maafi ki baat karta hain, toh Narendra Modiji aur Arun Jaitley ji kehte hain, yeh hamari policy nehi hain. Rs 8000 crore Siddaramaiah ji ne aur Congress party ki sarkar ne kisaan ka yahaan Karnatak me karja maaf kiya.'

While Gandhi used ‘maafi’, ANI’s translation said,

It is not clear if by ‘maafi’ he meant waiver or write-off. However, this was followed by the BJP and Karnataka Chief Minister Siddharamaiah sparring with each other on Twitter.

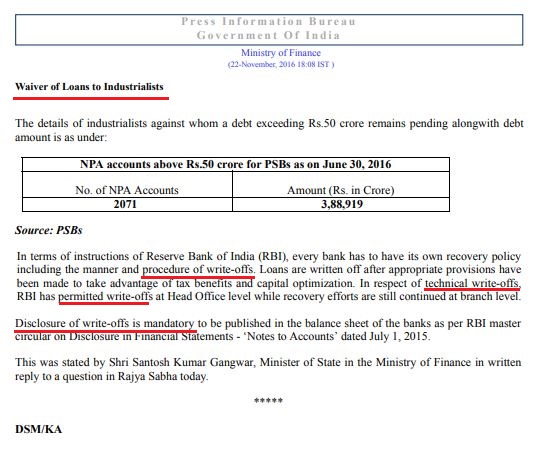

But it is not just Gandhi and Siddaramaiah, even government departments seem to be unclear about the correct usage of these terms. Below is a PIB circular by the Finance Ministry which has used both the words interchangeably.

BOOM explains what loan-waivers and loan write-offs mean and deconstructs its impact on the banking sector and economy.

Loan Waiver

A loan waiver refers to waiving off the liability of the borrower by the lending institution. Farmer loan waiver schemes announced by governments are one-time settlements of the loan in which the government takes over the burden of the loan and the farmer is freed from the liability.

The impact of loan waiver schemes are first felt by the balance sheets of banks. While they are later compensated by the government, such schemes also leave several macroeconomic impacts on the whole economy, said RBI Governor Urjit Patel while addressing a seminar on Agricultural Debt Waiver – Efficacy and Limitations, on September 2017.

Patel elaborates the effects of loan waiver schemes on public finance and economy as follows –

- It leads to increase in revenue expenditures for which the RBI has to engage in additional market borrowings which in turn result in higher interest rates in the economy. The high cost of borrowing acts as a disincentive for private borrowers which negatively impacts investment.

- In the case of allocations for loan waivers exceeding budgetary provisions, it widens the fiscal deficit which has inflationary effects. The opportunity cost is less government spending in other fronts and thus displeasing tax payers as a major share of tax revenue goes into financing loan waivers.

- Capital expenditure takes a hit even when allocations for loan waivers are within budgetary provisions. Lesser funds for capital expenditure affect investments in infrastructural development and asset creation, even for the agriculture sector. Infrastructural crunch shall have inflationary effects as cost of production goes up.

Though it clears debts of the farm households, it negatively impacts credit discipline and incentivises wilful defaulters. The Lok Sabha question dated January 2018 answered by Jaitley quotes a former RBI governor’s letter to the Chief Election Commissioner which cautions against political parties promising farm loan waivers as it incentivizes wilful default.

The last major debt waiver scheme announced by the central government was in 2008 - Agricultural debt waiver and debt relief scheme (ADWD) - of the amount Rs 52,000 crores (0.9 % of GDP) which converts to Rs 81,264 cr at current prices.

The central government under NDA is not in favour of loan waivers and has not announced loan waiver schemes during their term. However, different state governments (some of them ruled by the BJP) have announced loan waivers in 2017-18 with Uttar Pradesh, Tamil Nadu, Punjab, Andhra Pradesh and Telengana providing for it in their state budgets; Maharashtra and Karnataka announced loan waivers outside their budgets. Loan waivers announced by these seven states amount to Rs 88,065 crore – 0.5 percent of GDP.

Loan Write-Off

A loan is written-off when it is no longer an asset to the bank and the chances of recovery is slim and of less value. The bank follows certain procedures as per RBI guidelines to write-off a loan.

A loan is no more an asset to a bank when the borrower stops paying the monthly instalments and interest on it. The interest amount was otherwise the income that the bank generated out of the loan amount. Thus, the loan becomes a ‘Non Performing Asset (NPA)’.

According to RBI norms, a loan becomes an NPA when the interest/ and or instalment is overdue for more than 90 days.

Once a loan is classified as NPA, it is further categorized based on the period for which the asset remains non-performing.

- Substandard Asset – An asset that remained NPA for 12 months

- Doubtful Asset – Remained as a substandard asset for 12 months

- Loss Asset - When the loan is considered uncollectible and of less value as an asset

In all these stages, the bank shall continue efforts to recover the loss; and the liability of the borrower is not absolved.

The bank is primarily responsible for providing for the loss of assets. Once the asset is categorized as an NPA, the bank is required to provide for or set aside for the loss from its profits, ranging from 15% to 100% of the total outstanding amount.

The provisioning norms mandate banks to set aside even for a standard asset (loan) though at lower proportions, ranging from 0.25 -1 %. A substandard asset needs to be provided for 15% onwards of the total outstanding amount, a doubtful asset from 25% onwards and loss asset for 100%. Though the bank compensates for the losses, provisioning eats into the profit of the bank.

A loan is an asset for the bank but when it becomes a loss asset or uncollectible, the bank writes-off a loan or remove it as an asset from its balance sheet.

Writing off a loan helps in realistic estimation of assets and is of benefit to the bank as it reduces the tax liabilities which it was paying when the loan used to generate income.

NPAs and write-offs by Public Sector Banks (PSBs)

As shown below, gross advances (loan amount) of PSBs increased 4-fold from Rs 14.7 lakh crores to Rs 58.7 lakh crore over the decade (2007-2017). But it is a matter of serious concern that gross NPAs saw a steeper 17-fold jump to Rs 6.8 lakh cr from Rs 0.4 lakh crore in the corresponding period. The bulk of the NPA problem is concentrated in the public sector banks as opposed to private sector banks.

As shown below, the share of NPAs - substandard, doubtful and loss advances - has increased in the past two years.

The Finance Minister in his article 'The Fiction of Loan Waiver to Capitalists' in November 2017 held the UPA II government and Public Sector Banks responsible for the NPA crisis accounting to the aggressive lending to industrialists between 2008 - 2014.

He said, 'Rather than take firm decision with regard to such debtors, the then Government, through relaxation by banks in loan classification kept these defaulters as non-NPA accountholders. These loans were restructured through this, the loss to banks was kept hidden. The banks kept giving loans repeatedly to these debtors and kept ever-greening the loans'.

With stricter laws on NPAs, banks have been writing off their bad loans which were piling up over the years. Since they are primarily responsible, they also pay the price by compensating for the losses by providing for the bad loans thus, reducing their profits. Moreover, it also affect the bank's capital adequacy. Banks are required to maintain the owned capital to total asset ratio at 9%, according to Basel III norms.

Under NDA government, the loans written-off between 2014-17 stands at Rs 2.06 lakh crore.

While NPA provisioning by public sector banks (PSBs) stood at Rs 1.6 lakh crore in FY 17 and Rs 1.5 lakh crore in FY 16, they registered a net loss of Rs 0.11 lakh crore Rs 0.17 lakh crore, respectively. In 2013, NPA provisioning amounted to Rs 0.4 lakh crore and PSB's registered a net profit of Rs 0.5 lakh crore.

In view of the NPA crisis and to ease the capital crunch of PSBs, the government went ahead with recapitalization or infusing capital amounting to Rs 2.1 lakh crore into PSB's. It will be completed in two financial years - Rs 1.35 lakh crore through recapitalisation bonds, Rs. 18,139 crore of budget provision and the rest by diluting government shareholding.

Jaitley in his article said, 'Through capital infusion, banks weakened by NPAs would become strong and become capable of raising adequate capital from the market. For receiving this capital, banks will have to carry out several reforms, so that such situations do not recur.'

Like loan waiver schemes by governments, recapitalization is sourced from tax revenues, public savings and assets.

Waiver and Write-off are different banking concepts, but eats into taxpayer's money

Thus, the usage of loan waiver and loan write-offs as synonyms are factually wrong because the former frees the borrower from the liability while the latter will still hold the borrower liable though the recovery of the loan is not certain. The procedures of both are also different.

Thus, Rahul Gandhi is factually wrong in using these terms interchangeably. However, keeping aside the political blame game, both loan waiver schemes and loan write-offs are burdens to the economy and the tax payers.