'This NPA was your sin.'

"यह एनपीए आपका पाप था"

Prime Minister Narendra Modi blind sided the Congress, launching a scathing attack and holding the opposition squarely responsible for the NPA (non performing asset) crisis that has gripped the Indian banking sector.

The prime minister was replying to the Motion of Thanks to the president's address, on February 7th in the Lok Sabha. The accusations leveled by him made headlines.

BOOM decided to factcheck the claims made by the prime minister on the problem of NPAs.

Claim 1: Gross advances increased from Rs. 18 lakh crore in 2008 to Rs. 52 lakh crore in 2014

True. Gross advances of public sector banks increased as above, according to Reserve Bank of India (RBI) data. However, gross advances is not an absolute measure of NPAs because it only refers to the lending done by banks and not the loans that have gone bad.

Gross advances in 2014 of public sector banks stood at Rs. 52 lakh crore while that of all Scheduled Commercial Banks (SCB) stood at Rs. 68.7 lakh crore. SCBs include public sector, private sector and foreign banks.

PM Modi did not mention the NPA amount (Gross NPA) in absolute numbers. (**Note that the prime minister is referring to public banks only, where the bulk of the NPA problem is concentrated.)

While gross advances is the loan amount given by banks, a non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a certain period.

Gross NPAs rose to Rs. 2.3 lakh crore in fiscal 2014 from Rs. 0.4 lakh crore in 2008. Gross NPAs were Rs. 6.8 lakh crore in 2017.

2) CLAIM: Congress is 100% responsible for NPAs

A loan made to a company becomes an NPA due to several reasons. Not all loans that become NPAs are due to lax regulations or criminal intent. A company's inability to service its loan can be due to a slowdown in the economy, sectoral issues or inability of the company to run its business properly.

While Modi's accusation against the Congress can be called political, the Congress party cannot escape responsibility either for its inadequate response to the problem of NPAs during its ten year rule between 2004 to 2014.

While the PM held Congress responsible for the NPA mess, the Ministry of Finance cites "aggressive lending practices during upturn, laxity in credit risk appraisal and loan monitoring in banks and willful default or loan frauds in some cases, and slowdown in the global economy as reasons for spurt in stress assets" in a Lok Sabha question dated December 29, 2017.

To a separate Lok Sabha question if frauds in advances was a major reason for NPAs, the Ministry of Finance stated that between 2014 – 2017 (up to June) PSBs have reported fraud in advances amounting to Rs. 51,086 crore.

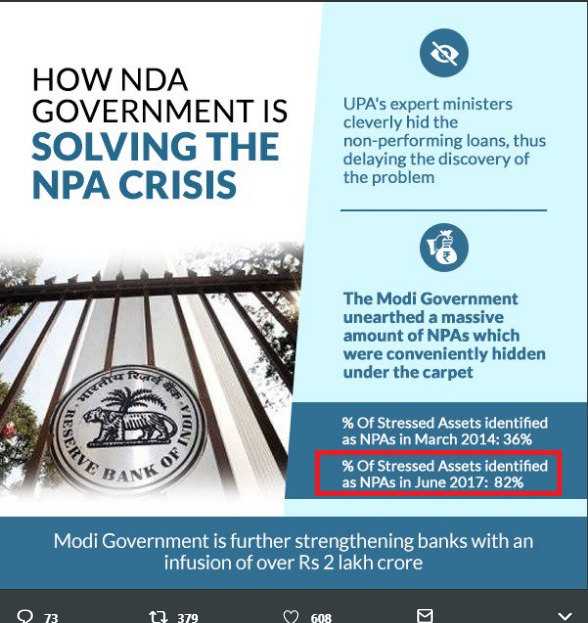

3) Claim: Not a single loan has turned into an NPA under Modi's government. Congress downplayed NPAs pegging it at 36% in 2014, while the BJP-led government found it to be at 82%.

The claim that no loan has turned into an NPA during 42 months of the NDA rule is unverifiable. A loan made to an entity does not turn into an NPA overnight and it would require analysis of data published by banks over a period of time to verify this claim.

But what has helped the BJP to make this claim is a statement made by RBI Governor Urjit Patel in February 2017. The governor was reported to have said that the NPA issue of the public sector banks was a legacy issue which was being discovered and reported lately. Patel said that many of these loans were funded prior 2011 -12.

The claim that Congress downplayed NPAs at 36% in 2014 whereas the NDA government discovered it was actually at 82%; is hard to verify.

This is because, the prime minister refers to the percentage figure (36%) as 'NPA' in his speech.

However, a graphic by BJP's Twitter handle called it 'percentage of stressed assets identified as NPAs' which is not the same as NPAs. (see the graphic below). It is not clear where the government got these numbers from.