[video type='youtube' id='o75RaR675YE' height='365']

A video by "Whistleblower News India" on the languishing state of 9 government banks is going viral on WhatsApp accompanied by the message that these banks risk closure by the Reserve Bank of India due to their bad loans problem.

The video published on June 24th by a relatively new and unknown YouTube channel uses data points without providing adequate context or precedence. It oversimplifies banking processes and arrives at a frightening conclusion.

Life savings and fixed deposits of customers who have invested in these banks could be at risk if the government forces RBI and in turn banks to take a haircut on some farm and corporate loans.

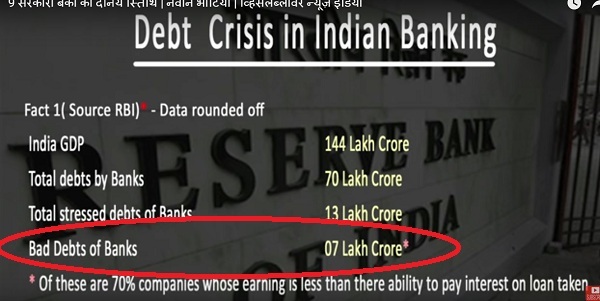

The video first gives an overview of Indian banks' NPA (Non Performing Asset) or bad loans problem. It lists the top 10 Indian group companies that owe thousands of crores to public sector banks.

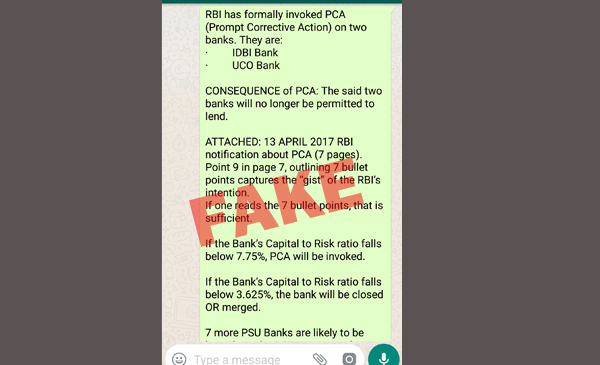

But the second half of the video where host Navin Bhatia speaks about the RBI's PCA framework for banks (Prompt Corrective Action) like it's the death knell for lenders, is way off.

PCA is an aggressive and interventionist step by the Reserve Bank of India that forces banks to tidy up their NPA mess. It is one of the measures at the RBI’s disposal to tackle the bad loan menace.

In fact, in a break from tradition the RBI even issued a clarification on PCA on June 5th (three weeks prior to this video) to put to rest the scaremongering about PCA on social media.

[blockquote width='100']

"The Reserve Bank of India has come across some misinformed communication circulating in some section of media including social media, about the Prompt Corrective Action (PCA) framework. The Reserve Bank has clarified that the PCA framework is not intended to constrain normal operations of the banks for the general public. It is further clarified that the Reserve Bank, under its supervisory framework, uses various measures/tools to maintain sound financial health of banks." - RBI

[/blockquote]

Source: RBI Clarification on Banks under Prompt Corrective Action

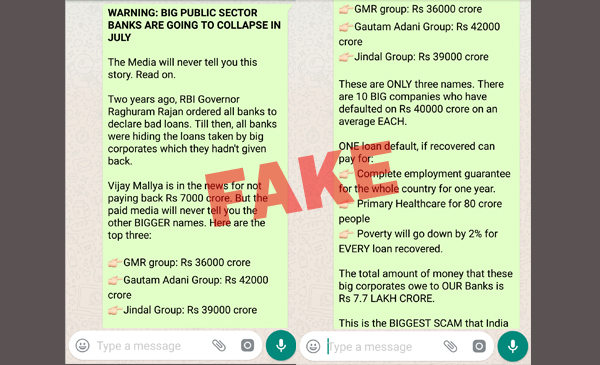

Sample the below WhatsApp forwards about PCA and public sector banks likely to collapse in July.

INDIAN BANKS' NPA PROBLEM

Indian banks have a problem. A huge bad loan problem. And it has worsened over the past three years. Credit Suisse pegged bank NPAs at 7.7 trillion rupees ( 9.6% of loans) in its research report date June 2nd. That means about 10% of total loans given by banks in India can be categorized as stressed.

Gross Non Performing Assets (GNPAs) in the banking system are estimated at about 8 lakh crore rupees, of which 6 lakh crore rupees is with public sector banks (PSBs), according to news reports.

A majority of these bad loans are concentrated in the resources and raw materials sectors such steel, cement, infrastructure etc.

RBI IDENTIFIES 12 MEGA LOAN DEFAULTERS

On June 13th, RBI identified 12 accounts of corporate loan defaulters that account for 25% of the total NPAs in the banking system. The central bank instructed banks to file insolvency proceedings against these companies, under the new Insolvency and Bankruptcy Code.

The regulator did not explicitly name these accounts however, media houses have created a list based on estimates of the indebtedness of these companies by large brokerage houses and research firms.

Source: RBI -RBI identifies Accounts for Reference by Banks under the Insolvency and Bankruptcy Code (IBC)

WHAT IS PROMPT CORRECTIVE ACTION (PCA)?

Simply put, PCA forces banks to take corrective measures and curb riskier activities to turn around their balance sheet. On April 13th, the RBI revised the framework of PCA. Under PCA, banks are assessed on capital ratios, asset quality and profitability. The framework also involves three thresholds where breach of any one could trigger PCA.

PCA norms allow the RBI to place certain restrictions such as stopping dividend payments and branch expansion. RBI can place limits on a bank's lending to one entity or sector if it deems it to be too risky or stressed. The banks’ promoters can be asked to bring in new management, too.

Source: RBI - Revised Prompt Corrective Action (PCA) Framework for Banks

Source: The Hindu - Prompt Corrective Action For Banks

WHERE THE VIDEO GETS IT WRONG

In the video, host Navin Bhatia literally puts words into the RBI's mouth. Bhatia states that in the RBI's April 13th statement on PCA, the central bank admitted that these companies are on the verge of going under.

This is false. RBI's circular said no such thing, neither did it mention any of the banks in any of its subsequent communication on PCA.

So far it has been the listed banks who have informed stock exchanges if they have been put under PCA by the RBI. (See IDBI's disclosure regarding PCA)

Six banks are currently under PCA, based on news reports analysed by BOOM.

1. IDBI Bank

2. UCO Bank

3. Dena Bank

4. Central Bank

5. Bank of Maharashtra

6 Indian Overseas Bank

An ICRA research report from May 2017 estimates that 16 public sector banks out of 21 (excluding State Bank of India associates) would need to initiate mandatory corrective actions under RBI's PCA framework. (Click here for ICRA Insight)

In such an event, will RBI allow these banks to fail and watch the banking sector implode? Whistleblower News India's video and numerous WhatsApp forwards do not address this question.

The video incorrectly states that under PCA, banks would stop lending. This is misleading since even the banks under PCA are carrying out normal operations with regards to retail customers.

BOOM does not wish to downplay the seriousness of the NPA crisis Indian banks are grappling with and we acknowledge that NPA resolution will be a difficult and long drawn process.

But the video paints a doomsday scenario without taking into account that the RBI has acted conservatively in the past and has never allowed a government bank to shutter overnight leaving depositors in the lurch.